Personal Loans

Personal Loans

We offer low rates and flexible terms.

5.99%

home equity

8.95%

personal loans

5.49%

auto loans

8.90%

VISA

Personal Signature Loan

The California Community CU Personal Loan is a quick and easy option when you need extra funds. Whether you will be using the funds for an unexpected expense, purchase an appliance, go on vacation or to consolidate debt, a California Community CU Personal Loan can help. And you can borrow as little as $500.00.

Added Benefits

*APR-Annual Percentage Rate. Loan amount may vary based on qualifications. Subject to approval based on creditworthiness. Other limitations may apply. **Term limits based on amount borrowed. Signature loan representative example: For a $5,000.00 loan with a 36-month term at 8.95% APR* funded with a first payment due date set at 30 days from the origination date, the payment would be $158.89 for 35 months, with a final payment of $158.88. Offer not available for the refinance of an existing California Community Loans.

Line of Credit Loan

A California Community CU Line of Credit offers you the ability to conveniently borrow money when needed. This signature Line of Credit gives you access to your available funds up to your approved limit. You’ll have peace of mind knowing you have immediate access to your Line of Credit Loan. Benefits of a California Community CU Line of Credit:

Added Benefits

*Loan amount may vary based on qualifications. Subject to approval based on creditworthiness. Other limitations may apply. LOC: a.) The minimum monthly payment required is the balance if equal to or less than $20.00. b.) If the balance exceeds $20.00 the minimum monthly payment is 4.00% of the balance or $20.00 whichever is greater.

Emergency Loan - Your Security Net

An unexpected event or emergency expense can turn your budget upside down. CACCU offers a smart alternative to costly payday loans... a fast, affordable option to get the cash you need to help get you back on your feet.

Added Benefits

Emergency Loan Requirements

*Annual Percentage Rate. On Approved Credit, Some Conditions Apply. Representative example: For a $500.00 loan with a 6-month term funded at 18.00% APR*, with a first payment due date set at 30 days from the origination date, the payment would be $87.80 for 5 months, with a final payment of $87.79.

Why is our Emergency Loan a smart alternative to a payday loan?

Payday loans carry extremely high-interest rates and short repayment terms. Part of the reason payday loans can get borrowers into trouble is due to their extremely short repayment terms. The repayment period on a payday loan is typically two weeks (the term with CACCU is up to 12 months!). The Consumer Finance Protection Bureau (CFPB) notes that on a two-week loan that carries a $15 fee per $100 borrowed, you would pay 400 percent interest (the Annual Percentage Rate with a CACCU Emergency Loan is only 10.00%!)

Payday loans likely won't help your credit. In many cases, payday lenders don't report on-time payments and loan payoffs to credit bureaus. This means these products don't help borrowers build credit. CACCU reports all payments to Experian and TransUnion. But, if someone misses payments or fails to repay the loan, the payday lenders will often report the delinquent account, further dragging down the borrower's credit score and making it that much harder to obtain better financing products in the future.

How to Avoid needing an Emergency Loan in the future. Open a separate savings suffix and have a portion of your direct deposit made to that suffix each time it is received. Start with a small amount such as 1% and increase it over time. Each time you receive a pay raise, put at least 10% of the amount into your savings account...you won't miss it since you were not receiving it in the first place.

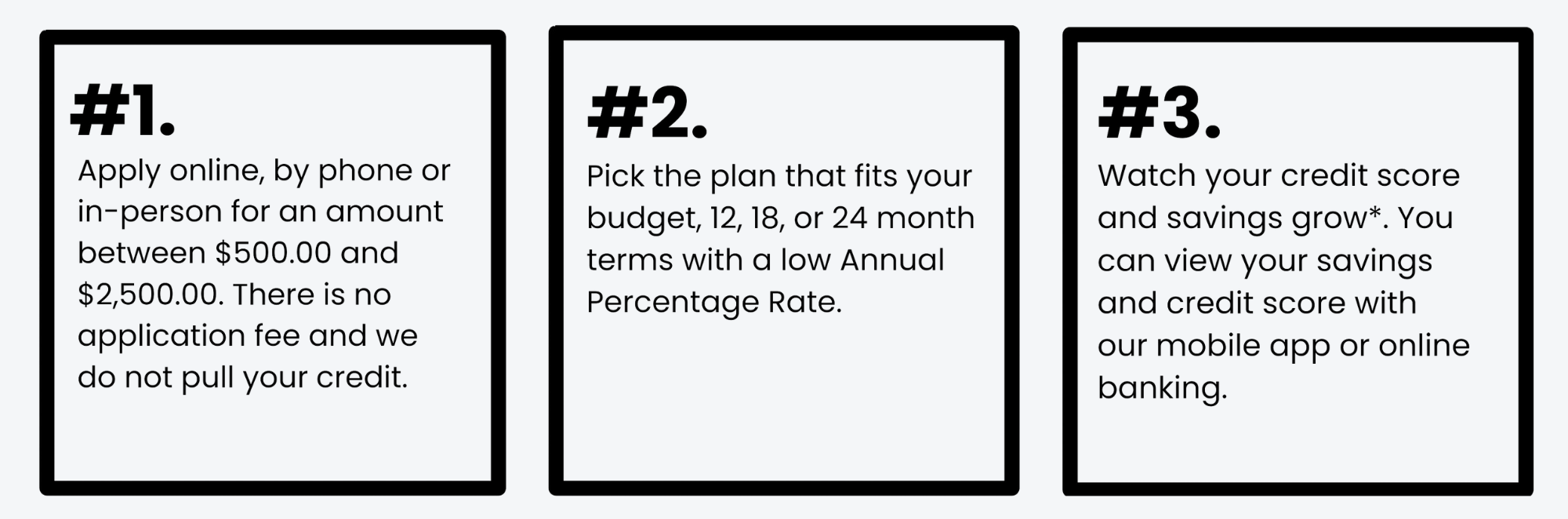

Credit Builder Program

A great way to build your credit score and watch your savings grow.

We are here to help you to succeed!

We Make It Simple:

*The funds from the loan are placed in a savings account in your name and placed on hold for the term of the loan. The savings account is collateral for your loan. After all the payments are complete you decide to keep the funds in the savings or use it for another purpose. Access your credit score, full credit report, financial tips and education using our mobile app or online banking.

Promotional Offers

Always something special for you.

Our promotional offers change often but are always designed to save you money.